So, why would you add these additional layers in the chart of account number? Additional account coding can make it easier to create financial statements. For example, in the preceding table, total cash can be determined by adding all accounts preceded with 10-10.

What Are Payment Terms in Business Transactions? A Comprehensive Guide

- That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions.

- In accounting, each transaction you record is categorized according to its account and subaccount to help keep your books organized.

- For example, you might use the 1000 series for current assets, starting with Cash at 1010, Accounts Receivable at 1020, and so on, leaving room between numbers for future accounts.

These accounts track all money coming into your company and also record anything of value that your business owns, including real estate, company cars, inventory, and cash. In addition to keeping individual transaction records, you should also create a chart of accounts as part of your bookkeeping. Essentially, it’s a list of all of your company’s financial accounts organized in a general ledger. A chart of accounts is a catalog of account names used to categorize transactions and keep your business’s financial history organized. There’s often an option to view all the transactions within a particular account, too. Small businesses may record hundreds or even thousands of transactions each year.

Cash Flow Statement

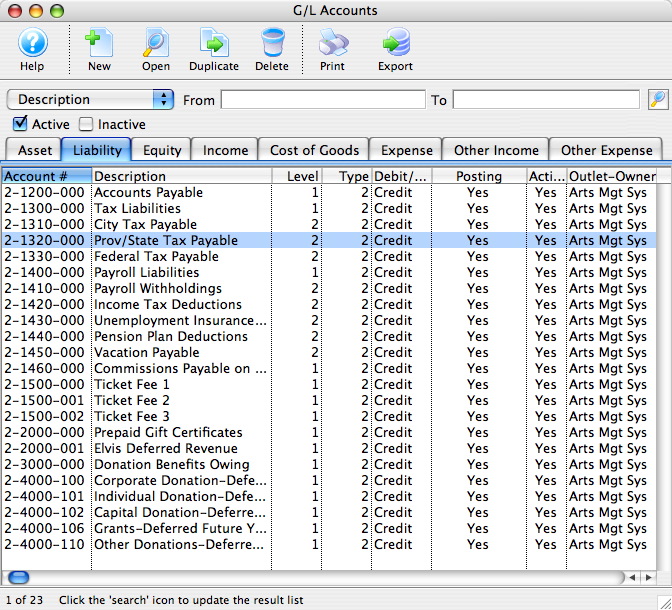

Some businesses also include capital and financial statement categories. To create a COA for your own business, you will want to begin with the assets, labeling them with their own unique number, starting with a 1 and putting all entries in list form. The balance sheet accounts (asset, liability, and equity) come first, followed by the income statement accounts (revenue and expense accounts). Suppose the business has two departments, a production department and a marketing department, and wants to be able to identify its expenses between the two. All other account types (assets, liabilities, equity, and revenue) are not separated and are to be recorded in a default code referred to as the General department.

Double Entry Bookkeeping

When recording transactions, such as a purchase of new equipment, you’d debit the cash account and credit the equipment account to reflect the use of cash assets to acquire new assets. A chart of accounts is a tool used to categorize and organize all the financial transactions in a company’s accounting system. On the other hand, a balance sheet is a financial xero community statement that provides a snapshot of a company’s financial position at a specific point in time. The balance sheet is generated using the data from the chart of accounts, which is separated into assets, liabilities, and equity sections. The five main categories in the chart of accounts are assets, liabilities, equity, revenue, and expenses.

Payroll Expenses

Your COA is a useful document that lets you present all the financial information about your business in one place, giving you a clear picture of your company’s financial health. To better understand how this information is typically presented, you may want to review a sample of financial statement. This can help you visualize how your chart of accounts translates into formal financial reporting. While the chart of accounts can be similar across businesses in similar industries, you should create a chart of accounts that is unique to your individual business. You should ask yourself, what do I want to track in my business and how do I want to organize this information? For example, we often suggest our clients break down their sales by revenue stream rather than just lumping all sales in a Revenue category.

Best Accounting Software for Small Businesses of 2024

We believe everyone should be able to make financial decisions with confidence. Sales returns are amounts refunded to customers or deducted from the total income due to product returns, discounts, or cancellations. The account name is the given title of the business account you’re reporting on, such as bank fees, cash, taxes, etc.

Instead of lumping all your income into one account, assess your various profitable activities and sort them by income type. Income is often the category that business owners underutilize the most. Some of the most common types of revenue or income accounts include sales, rental, and dividend income. There are many different ways to structure a chart of accounts, but the important thing to remember is that simplicity is key. The more accounts are added to the chart and the more complex the numbering system is, the more difficult it will be to keep track of them and actually use the accounting system.

The division code is then added to the current five digit code to create a 7 digit chart of accounts numbering system. The general format of the 5 digit chart of accounts numbering system is therefore XX-XXX where the first 2 digits are the department code and the last three digits as before represent the account code. For example by adding the relevant department code to the wages expense account code 620 referred to above, a separate account is created which will identify the wage expense for that specific department. The accounts codes structure seeks to organize the general ledger by grouping similar account types together in ranges.

Although most accounting software packages like Quickbooks come with a standard or default list of accounts, bookkeepers can set up and customize their account structure to fit their business and industry. The code used will depend on the complexity of the business and the amount of detail required from its financial reporting system. Now, the trial balance (the summary of all account balances) checking account balance reflects $125,453 at the end of May which is included in the financial statements. Next, I’ll show you how the chart of accounts is a part of the financial statement building process. Below, I explain what a chart of accounts is and how you will use it in bookkeeping and accounting. Current liabilities, or short-term liabilities, are obligations that are due within one year.

Many small businesses opt to utilize online bookkeeping services, not only for invoicing and expense tracking but also for organizing accounts and ensuring tax season goes smoothly. FreshBooks accounting software is an affordable and reliable option for online bookkeeping services that will help you stay on track and grow your business. To better understand the balance sheet and income statement, you need to first understand the components that make up a chart of accounts. Knowing how to keep your company’s chart organized can make it easier for you to access financial information. As a business develops and grows it establishes departments such as, for example, production, design, sales & marketing, and accounting departments.