But using the income summary account was used to give a clear view of the company’s performance when there was only manual accounting. Usually, where the accounting is automated or done using software, this intermediate income summary account is not used, and the balances are directly transferred to the retained earnings account. The temporary accounts need to be zero at the end of an accounting period. Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts.

- Temporary accounts are closed or zero-ed out so that their balances don’t get mixed up with those of the next year.

- The $10,000 of revenue generated through the accounting period will be shifted to the income summary account.

- Temporary accounts are used to record accounting activity during a specific period.

- What is the current book value ofyour electronics, car, and furniture?

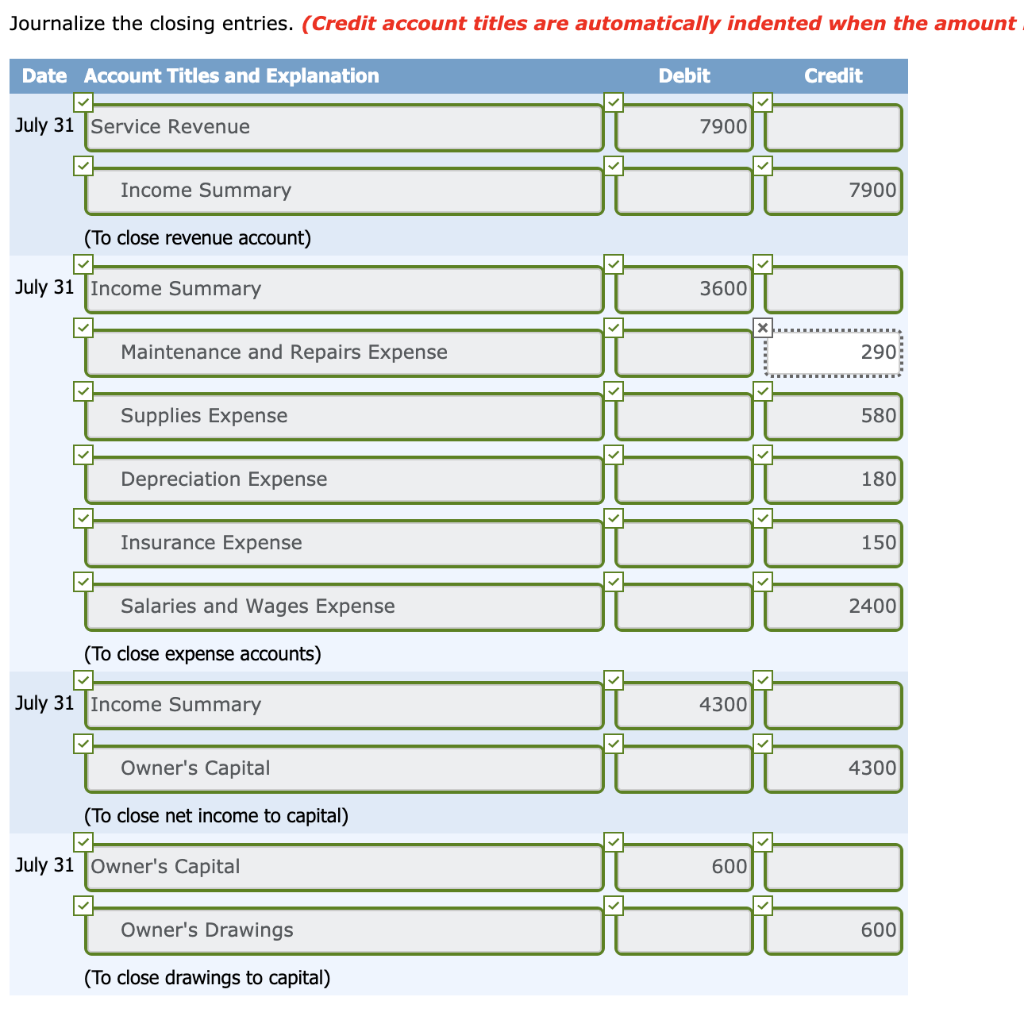

Step 2: Close Expense accounts

In other words, they represent the long-standing finances of your business. That’s exactly what we will be answering in this guide – along with the basics of properly creating closing entries for your small business accounting. The year-end closing is the process of closing the books for the year. This involved reviewing, reconciling, and making sure that all of the details in the ledger add up. Closing entries are an important facet of keeping your business’s books and records in order. By maintaining your bookkeeping, you can ensure that you are constantly kept informed.

What is the approximate value of your cash savings and other investments?

Are the value of your assets andliabilities now zero because of the start of a new year? Your car,electronics, and furniture did not suddenly lose all their value,and unfortunately, you still have outstanding debt. Therefore,these accounts still have a balance in the new year, because theyare not closed, and the balances are carried forward from December31 to January 1 to start the new annual accounting period. As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200.

Great! The Financial Professional Will Get Back To You Soon.

An individual might define their net income as the portion of their paycheck they can spend on discretionary expenses after taxes have been withheld and they’re reserved an adequate portion to meet their monthly budget. The term can also mean whatever they receive in their paycheck after taxes have been withheld. The term “net” relates to what’s left of a balance after deductions have been made from it. Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation. The number of closing activities may be quite substantially longer than the list shown here, depending upon the complexity of a company’s operations and the number of subsidiaries whose results must be consolidated. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. Let’s move on to learn about how to record closing those temporary accounts. Remember, dividends are a contra stockholders’ equity account.It is contra to retained earnings. The remaining balance in Retained Earnings is$4,565 (Figure5.6).

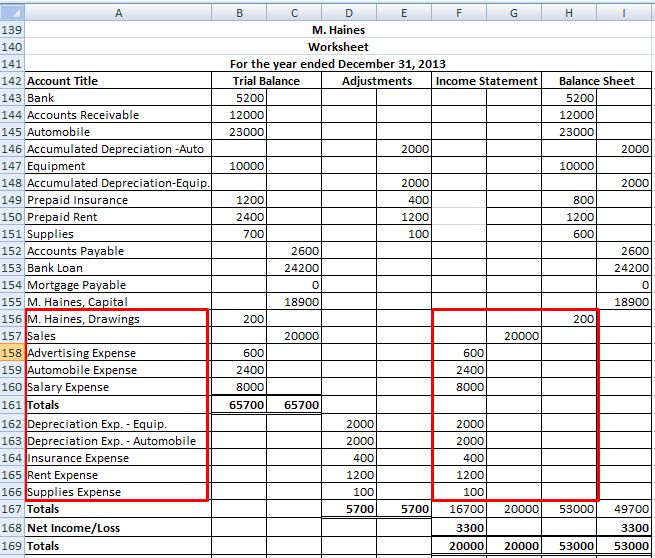

Example of Closing Journal Entries

Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship). Income and expenses are closed to a temporary clearing account, usually Income Summary. Afterwards, withdrawal or dividend accounts are also closed to the capital account. This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary.

Although the drawings account is not an income statement account, it is still classified as a temporary account and needs a closing journal entry to zero the balance for the next accounting period. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period. Closing entries are journal entries you make at the end of an accounting cycle that movie temporary account balances to permanent entries on your company’s balance sheet. A term often used for closing entries is “reconciling” the company’s accounts. Accountants perform closing entries to return the revenue, expense, and drawing temporary account balances to zero in preparation for the new accounting period.

The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements. These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. These accounts must be closed at the end of the accounting year. A closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings).

At the end of the accounting year 2018, the expense account needs to be credited to clear its balances, and the Income summary account should be debited. Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary. The next day, January 1, 2019, ad valorem property tax you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year? You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food.