However, it’s worth noting that the study is now almost seven years old and largely happened before the AI & automation wave hit finance. To give some context, publications often cite The American Productivity and Quality Center’s (APQC) 2017 General Accounting Open Standards Benchmarking survey as a benchmark for month-end close cycles. The balance of the Income Summary account is transferred to the Retained Earnings account. Since QuickBooks automates the year-end close, you don’t have to get caught up with all of these manual entries unless something was to go wrong. Even then you can get a bit of help or an accountant to sort you out.

- Notice that the Income Summary account is now zero and is readyfor use in the next period.

- In summary, the accountant resets thetemporary accounts to zero by transferring the balances topermanent accounts.

- This process highlights a company’s financial performance and position.

- Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc.

- It is really determined by a company’s need for financial reporting.

- To close expenses, we simply credit the expense accounts and debit Income Summary.

Closing Entry in Accounting: Definition and Best Practices

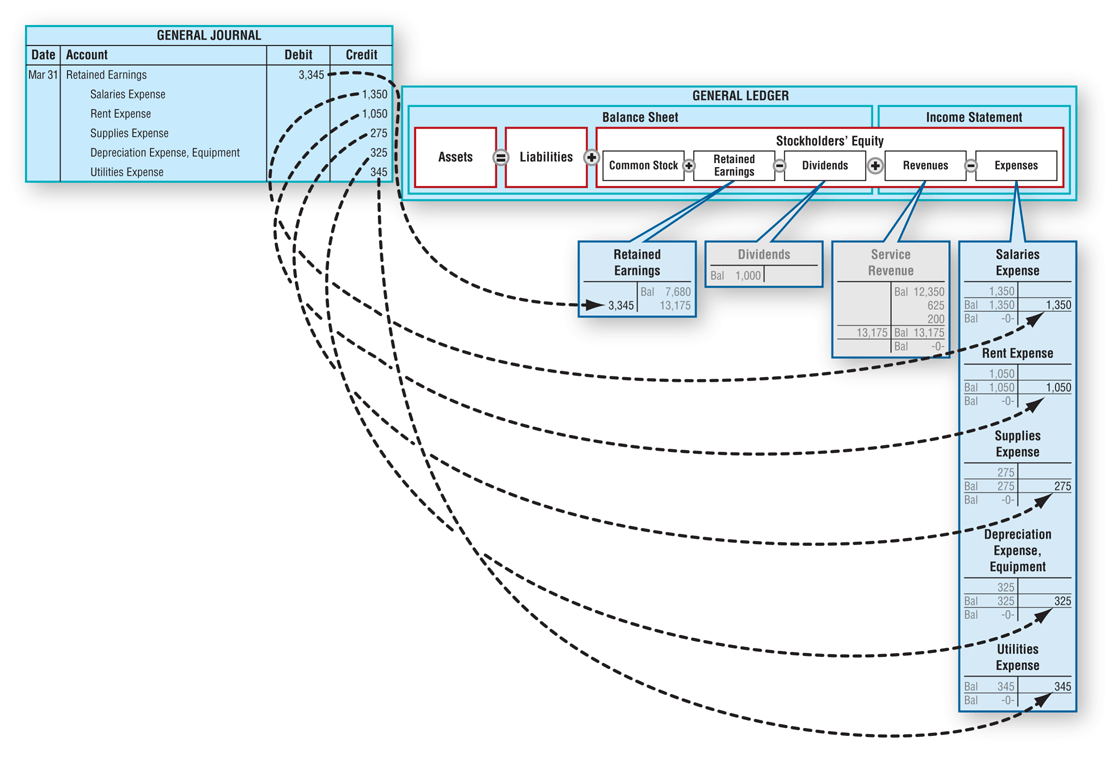

To close the drawing account to the capital account, we credit the drawing account and debit the capital account. To close expenses, we simply credit the expense accounts and debit Income Summary. To close that, we debit Service Revenue for the full amount and credit Income Summary for the same. In short, a close checklist works to streamline the close process, helping teams to budget time, set mid-close deadlines, and remain accountable for all close tasks.

Temporary and Permanent Accounts

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Which of these is most important for your financial advisor to have?

We don’t want the 2015 revenue account to show 2014 revenue numbers. If your revenues are less than your expenses, you must credit your income summary account and debit your retained earnings account. Total revenue of a firm at the end of an accounting period is transferred to the income summary account to ensure that the revenue account begins with zero balance in the following accounting period. In this case, if you paid out a dividend, the balance would be moved to retained earnings from the dividends account. Once this has been completed, a post-closing trial balance will be reviewed to ensure accuracy. At the end of a financial period, businesses will go through the process of detailing their revenue and expenses.

To Ensure One Vote Per Person, Please Include the Following Info

They zero-out the balances of temporary accounts during the current period to come up with fresh slates for the transactions in the next period. You might be asking yourself, “is the Income Summary accounteven necessary? ” Could we just close out revenues and expensesdirectly into retained earnings and not have this extra temporaryaccount?

Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow. The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period. At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with. In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year. In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner.

Another essential component of the Highradius suite is the Journal Entry Management module. This module automates the creation and management of journal entries, ensuring consistency and accuracy in your financial statements. Organizations can achieve up to 95% journal posting automation with a pre-filled template, reducing errors and discrepancies and providing a reliable view of financial data. Automation transforms the process of closing entries in accounting, making it more efficient and accurate. By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors.

Well, dividends are not part of the income statement because they are not considered an operating expense. In other words, they represent the long-standing finances of your business. The Income Summary balance is ultimately closed to the capital account. Implementing these best practices helps streamline the month-end close process, making it more efficient and accurate. This allows your business to focus on strategic goals and decision-making with confidence.

As we mentioned, these include revenue, expense, and dividend accounts. Closing entries transfer the balances from the temporary accounts to are political contributions tax deductible a permanent or real account at the end of the accounting year. Closing entries are put into action on the last day of an accounting period.

On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below. First, all the various revenue account balances are transferred to the temporary income summary account. This is done through a journal entry that debits revenue accounts and credits the income summary. In other words, the closing entry is a method of making repayments on all the costs incurred within a given financial year.