This method includes all the direct costs of making a product. It gives a more complete picture of the true cost of production. So while variable costing might seem simpler, it’s just not up to snuff for official financial reporting. If the 8,000 units are sold for $33 each, the difference between absorption costing and variable costing is a timing difference. Under absorption costing, the 2,000 units in ending inventory include the $1.20 per unit share, or $2,400 of fixed cost.

Cost Accounting Insights

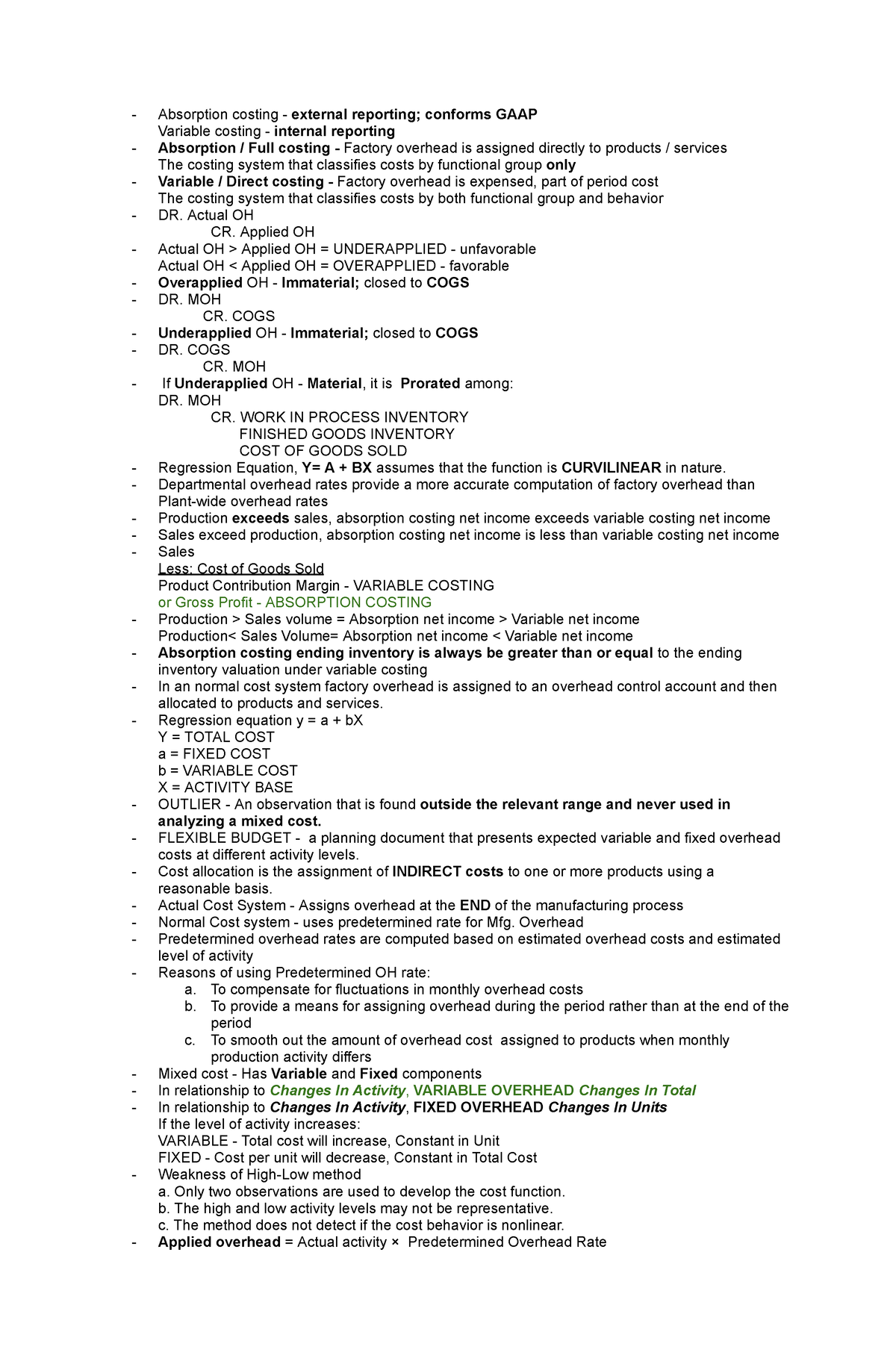

In variable costing, profit is a function of sales volume only. But under absorption costing sales and production (production creates inventory) both influence profit of a period. Profit in variable costing is not affected by changes in inventory as it is in absorption costing. In absorption costing, profit may decline although sales have increased. If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time.

Variable Costing vs. Absorption Costing

Absorption costing can cause a company’s profit level to appear better than it actually is during a given accounting period. This is because all fixed costs are not deducted from revenues unless all of the company’s manufactured products are sold. Operating income on the income statement is one of the most important results that a manufacturing company reports on its financial statements. External parties such as investors, creditors, and governmental agencies look to this amount to evaluate a company’s performance and how it affects them.

How do you find net income from variable costing?

For example, a CEO could postpone the closing of a loss-making business because doing so would reduce his GAAP-based bonus, causing further harm to shareholders. Firms increasingly report a number called non-GAAP or pro-forma earnings along with earnings based on Generally Accepted Accounting Principles (GAAP). Non-GAAP is a customized version of earnings calculated after excluding earnings components that don’t require cash payments or are otherwise not important for understanding the future value of the firm. Then they detail each item that was added or subtracted from GAAP earnings to arrive at non-GAAP earnings. For example, if a business that produces 500,000 units per years spends $50,000 per year in rent, rent costs are allocated to each unit at $0.10 per unit. If production doubles, rent is now allocated at only $0.05 per unit, leaving more room for profit on each sale.

Absorption Costing Explained

First, it is critical to understand that the $598,000 in manufacturing costs for 1,000,000 phone cases include fixed costs such as insurance, equipment, building, and utilities. As a result, when deciding whether to accept this special order, we should employ variable costing. Businesses use two basic costing approaches variable costing and full costing.

It may be beneficial to use the variable costing method depending on a company’s business model and reporting requirements or at least calculate it in dashboard reporting. Managers should be aware that both absorption costing and variable costing are options when reviewing their company’s COGS cost accounting process. Variable costing doesn’t add fixed overhead costs into the price of a product so it can give a clearer picture of costs.

Rather than discontinuing a product based on negligible profits, a manager can use variable costing to determine the overall costs of keeping a unit in production. ABC costing assigns a proportion of overhead costs on the basis of the activities under the presumption that the activities drive the overhead costs. As such, ABC costing converts the indirect costs into product costs. There are also cost systems with a different approach. Instead of focusing on the overhead costs incurred by the product unit, these methods focus on assigning the fixed overhead costs to inventory. The rationale for absorption costing is that it causes a product to be measured and reported at its complete cost.

- But under absorption costing sales and production (production creates inventory) both influence profit of a period.

- Additionally, different costing methods provide varied insights into operational efficiency and cost control, helping managers make informed decisions to enhance profitability and competitiveness.

- The costing system should provide the organization’s management with factual and true financial information regarding the organization’s operations and the performance of the organization.

- The difference between fixed and variable costs is essential to know for your business’s future.

- Together, these principles are meant to clearly define, standardize and regulate the reporting of a company’s financial information and to prevent tampering of data or unethical practices.

On the contrary, absorption costing allows income to rise in tandem with production. Absorption costing fails to provide as good an analysis of cost and volume as variable costing does. If fixed costs are an especially large part of total production costs, it is difficult to determine variations in costs that occur at different production levels. This makes it more difficult for management to make the best decisions for operational efficiency.

Instead, total fixed factory overhead is treated as a period cost that is deducted from gross profit. To allow for deficiencies in absorption costing data, strategic finance professionals will often generate supplemental data based on variable costing techniques. As its name suggests, only variable production costs are assigned to inventory and cost of goods sold. These costs generally consist of direct materials, direct labor, and variable manufacturing overhead. Fixed manufacturing costs are regarded as period expenses along with SG&A costs. In some ways, this understates the true cost of production.

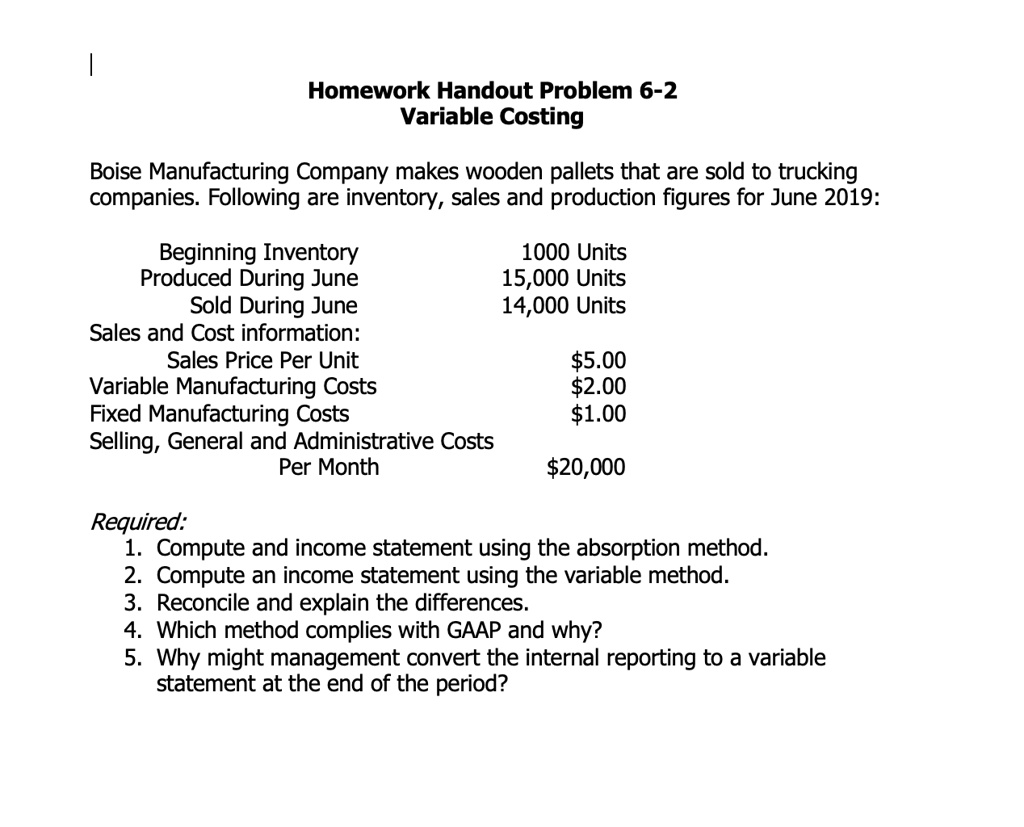

The difference is that the absorption cost method includes fixed overhead as part of the cost of goods sold, while the variable cost method includes it as an administrative cost, as shown in Figure 6.12. Variable costing is generally not used for external reporting purposes. Under the Tax Reform Act of 1986, income statements must use absorption costing to comply with GAAP. Managers use variable costing to determine which products to offer and which products to discontinue.

Production is estimated to hold steady at 5,000 units per year, while sales estimates are projected to be 5,000 units in year 1; 4,000 units in year 2; and 6,000 in year 3. Production is estimated to hold steady at \(5,000\) units per year, while sales estimates are projected to be \(5,000\) units in year \(1\); \(4,000\) property tax deduction definition units in year \(2\); and \(6,000\) in year \(3\). So, whether you’re making widgets or giving advice, GAAP wants you to show all your costs. It’s about painting the whole financial picture, not just part of it. Sometimes it overshoots, sometimes it undershoots. Cost accounting isn’t just about crunching numbers.